WHAT IS A DONATION OF SHARES?

Donating publicly traded stocks, bonds, mutual funds and other securities is a tax advantage that benefits you. You give more, you pay less.

You generally have to pay 50% as capital gains tax on your stocks or mutual funds. If your donation is made directly to the Foundation, you are exempt from capital gains tax.

By making a donation of shares, you allow the En Cœur Foundation to ensure the sustainability of the services offered to children with heart disease and their families by providing an ongoing source of funding.

Donate shares

Ready to donate shares or would you like more information? Please contact us:

514-737-0804 (extension 2)

encoeur@en-coeur.org

ADVANTAGES

Issuance of a tax receipt

Benefit from a tax credit on your donation

Tax advantage

Exemption from capital gains tax

Give more

Thanks to the tax savings made, you contribute directly to the well-being of families of children with heart disease and enable the Foundation to pursue its mission.

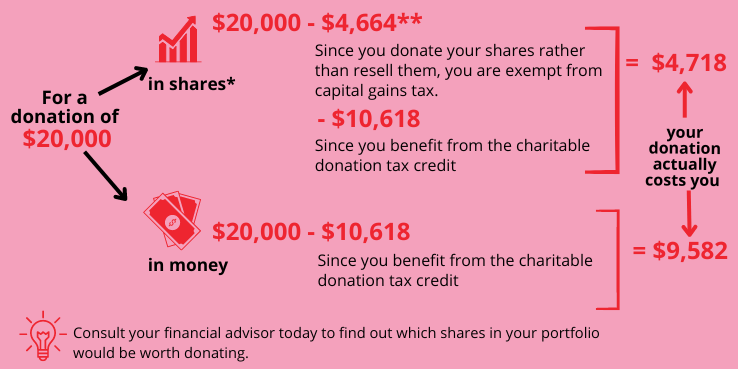

BONIFICATION OF YOUR DONATION OF SHARES

*on which there is a high capital gain, shares whose price has risen, etc.

**assuming a cost base of $2,500 and a tax rate of 53.3%.

This information is provided for illustrative purposes only. Please contact a financial planning advisor to find out which donation option is best for you. Your receipt will be calculated based on the closing share price on the day the shares are legally transferred to the Foundation account.

Ready to donate shares or would you like more information? Please contact us:

514-737-0804 (extension 2)

CHANGING LIVES BY GIVING MORE

Doris Jacques and Jaques Lafrance :

Grandparents of Corinne, child with heart disease, and donors of shares

“Residing in Lac St-Jean, our son and his wife knew from ultrasound at 30 weeks of pregnancy that the heart of their unborn baby showed a transposition of the great vessels. Corinne therefore had to undergo open-heart surgery shortly after her birth at the Centre mère-enfant Soleil in Quebec City. Since her condition was known in advance and because she was born at term, the medical team was ready to act. There were no complications and today she’s doing just fine.

But what a planification nightmare: the temporary move to Quebec City 5 weeks before the expected delivery date with their 2-year-old daughter as well as parents and grandparents. Then, 2 weeks before the birth, the whole family moved in for 6 weeks in an apartment located at a 2 minutes’ walk from the hospital. Despite the surgery that awaited Corinne, it was a gift to know in advance, to have the time, the financial means and grandparents available to deal with the situation.

By talking with parents and grandparents at the hospital, we learned that most of the children were born prematurely. Many parents were self-employed, with employment but without the possibility of paid leave or waiting 6 weeks before receiving parental leave benefits. Parents from remote areas also had to find accommodation…

Fortunately, En Coeur was there to help them financially.

For all these reasons, it has become important for us to make a donation to En Cœur and we have chosen to donate shares because it allows us to GIVE MORE! Indeed, the donation of shares allows the donor to avoid having to pay capital gains tax, otherwise payable upon the sale of the shares, while En Coeur enjoys the full amount of the value of the shares at the time of the donation.”